Flexible funding for unexpected expenses

We provide fast, easy and safe financing tailor-made for consultants.

Simple financing for consultants

If you want to send an invoice for a gig, and you don’t have your own company Good cash flow just makes life easier, and as a consultant you sometimes need more flexibility. We have the solutions whether you need a loan to cover a large expense or a on-demand access to cash.yet, you’ve come to the right place:

- Competitive interest rate and transparent fees

- Cash within 24 hours

- Business loan with flexible terms and no starting cost

Choose the best financing option for your business

Choose a solution, fill in the form and you will hear from us within a day.

Instant

payment service

We provide financing when you have cash tied up in unpaid invoices. For a small fee you get access to funds sooner.

Features:

- Cash within 24 hours, up to 1 MSEK per year

- Competitive interest rate under 1.75 %

- Easy administration

Credit card

Get easier access to credit and easier administration with Werkey card, which is also gives you discounts and offers on products and services aimed at consultants.

Features:

- Credit card for daily and unforeseen expenses

- Up to 45 days of free credit

- 10% discount on Werkey administration

Business loan

You get a lower interest rate than a line of credit and pay a set amount each month. Each application is reviewed and priced based on your business circumstances.

Features:

- No starting cost

- No hidden fees

- Flexible terms

WERKEY FINANCE

Let us help optimise your cash flow so you can get back to business

Get more information about the finance solution that fits your needs.

Fill out the form

“It was an easy process. Werkey reviewed my application and gave me a positive answer. All in one day!”

Fredrik Andersson, 36

“It was an easy process. Werkey reviewed my application and gave me a positive answer. All in one day!”

Fredrik Andersson, 36

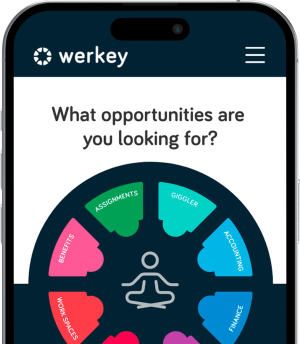

Everything you need to succeed as a consultant

Download the app to access exciting assignments and great services to improve your consultant business.

Find out which financing option is right for you

When to go for instant payment

Instant payment quickly frees up capital for everything from short-term expenses to new investments. Outsourcing invoice administration also frees up time to manage your business. You pay a fee for the service, which means a reduction in your profit margin on each invoice.

When a credit card works best

Ideally you should only use a credit card for purchases you can pay off by the following month. Since the credit card interest rate is quite high, it’s better to use a line of credit, or even a loan, for larger purchases.

When to consider a loan

A loan usually offers a lower interest rate than a line of credit. That means you pay a set amount each month. Like us, many many of our consultants like knowing what to budget for the expense each month.

Other Werkey services

The best membership in town: networking, discounts and freebies

DISCOVER INSPIRING WORK SPACES AROUND THE WORLD

New to consulting? Use Giggler to send invoices without a company